Sustainability investment by family offices ( FOs ) remains intact despite global sentiment shifts away from the theme led by the US, according to a recent report.

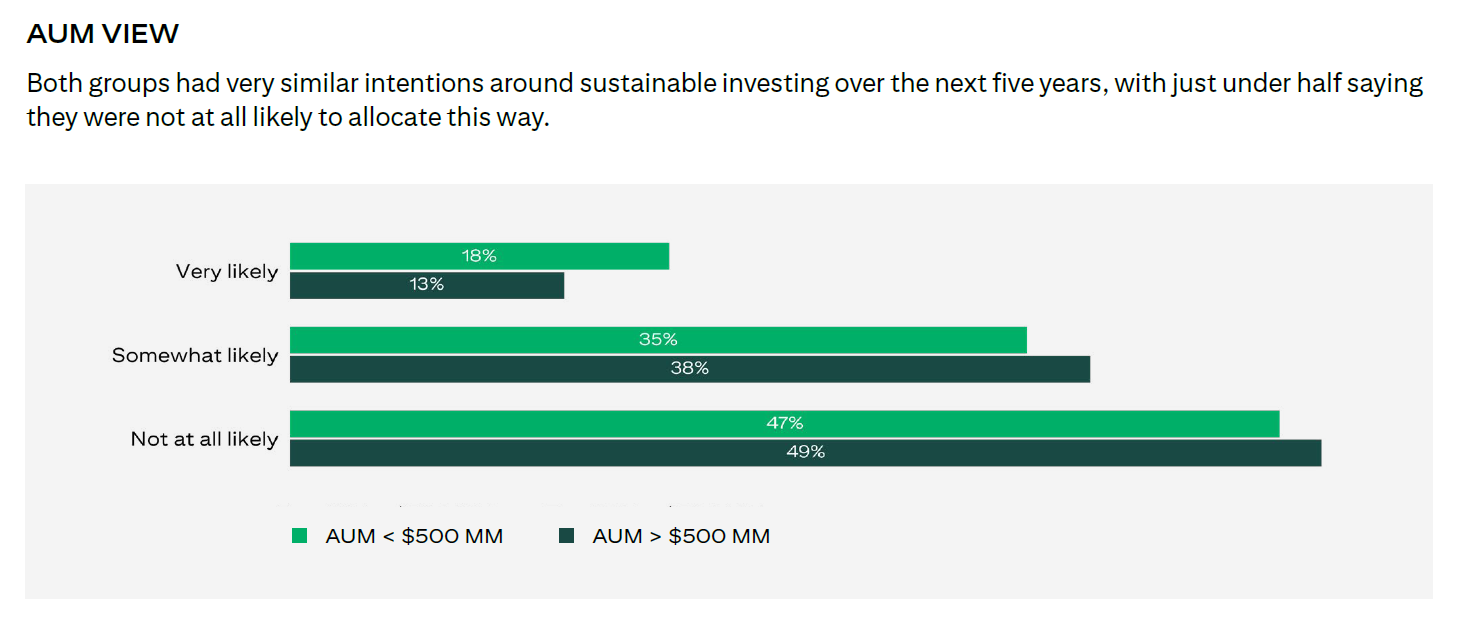

The majority of FOs still demonstrate unwavering support towards sustainability investing, with more than half of the surveyed families reporting interest investing in this asset class in the next five years, finds Citi’s 2025 Global Family Office Report, which interviewed more than 340 family offices worldwide.

“While recent policy developments in the US are less favourable to the energy transition,” the report states, “FOs realize the long-term secular trend is intact.”

The effectiveness of sustainable investing, the report adds, has been enhanced by the increasing emphasis on energy transition, national security and technological advancement. As such, sustainable investments are able to align with the investment strategies of the wealthy families at a higher level.

Likelihood of FOs with different AUM to take part in sustainable investing

Source: Cit’s 2025 Global Family Office Report

Asia-Pacific families are relatively more enthusiastic towards sustainability investment than those from other regions, with close to two-thirds of them reporting that they are likely to invest in this area, compared with 52% globally, 45% in North America and 51% in Europe, the Middle East and Africa.

Still, competitive returns, the report highlights, remain a top concern to family offices. Worries around the mismatch of sustainability objectives and investment strategies are the most evident in Asia, while the lack of compelling choices have also dampened FOs interest in sustainability investment.

“The observed shift in sustainable investing priorities reflects changes under the new US administration,” the report explains, “but also the maturation and evolution of the sustainable investing landscape itself.”

Next-gen takes over

With first generations ceding control, the values and opinions of the next generation have begun to instil a widespread influence to the family’s investment and business operation.

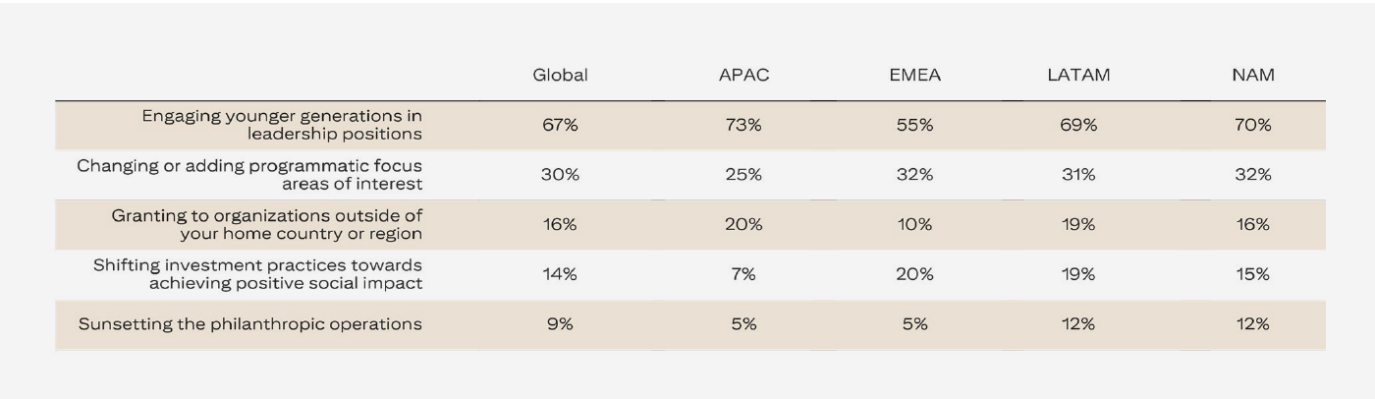

Anticipated changes to philanthropy in the next five years

Source: 2025 Global Family Office Report by Citi

As the intergenerational wealth transfer gathers pace, families in Asia-Pacific appeared to have the most concerned senior family members when it comes to handing over the control of philanthropy to their heirs. However, in other regions, including those of North America and Europe, Middle East and Africa, inheritance is also a hotly discussed issue.

Creating social values

Philanthropy is increasingly leveraged, the report notes, as a new source of financing to drive sustainability development, backed by families who realized their influence can have a positive environmental and social impact.

As such, more than 20% of the reports respondents note that they are doubling down on the projects that demonstrate social impact in a move to facilitate collaboration between governments and the private wealth sector.

Meanwhile, Asia-Pacific families appeared to be the most reluctant to inject capital in commercial social projects, with the region having the lowest rate of families scaling up such activities. As well, they rarely invest in social start-ups, and only 1% of the surveyed respondents invest in impact-linked bonds.

“Philanthropy cannot solve pressing global issues alone,” the report shares, adding that the involvement of private sector capital and governments is required as well. “Philanthropy can take risk and act as a catalyst, aiming to draw in private sector participants to build and finance the business case, while governments can make system changes and help scale proven concepts.”